The following provocation by Cerasela Stancu forms one part of Financing the Future, our dynamic content project exploring the market opportunities for impact investment in Aotearoa New Zealand. The project is produced by Pure Advantage in association with the Impact Investing National Advisory Board Aotearoa New Zealand and the Responsible Investment Association of Australasia. Access the full project here.

New Zealand is a leader in conservation practices and has expertise in agri-investment. We can capitalise on these attributes and capture the value of sustainable land use transformation.

A snapshot of land use state of play

Agriculture and food production have been key to our economic growth but are also main drivers for environmental and ecosystem change in New Zealand. Primary sector exports have reached NZ$42 billion this year and there is a continuing effort to seek export growth and enhance (on-farm) productivity. There are over 12 million hectares of land in primary production (pasture, forestry, cropping, horticulture) and lending to NZ agri-business which has reached NZ$41.1b in 2017. Dairy land area has increased by about 40 percent since the late 90s and even though the median price per hectare paid for dairy farms has decreased in the past 12 months, it remains a highly desirable asset in the primary sector.

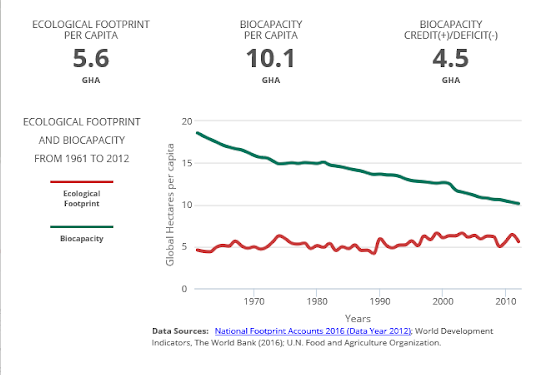

The economic importance of the sector is, however, matched by its impact on the environment and natural resources: the sector is responsible for almost half of our greenhouse gas emissions, the continuing loss of soil and indigenous biodiversity and poor state of our freshwater. Agriculture intensification and urban expansion has led to a loss of 70,000 ha indigenous cover between 1996 and 2012 and 190 million tonnes of valuable soil is lost through erosion every year. Our overall bio-capacity is on a continuous decline even if our ecological footprint stays the same.

New Zealand farmers and landowners are faced with the challenge of biosecurity incursions and the need to earn their licence to operate by decreasing impacts on water and reducing carbon emissions. Yet, high leverage at the farm level and a lack of sufficient knowledge and skills to start the transformation towards sustainable land use and ecological regeneration has so far prevented meaningful change.

Impact investment and conservation

Impact investment, and specifically conservation investment, refers to investments made with the intention to generate a return while delivering a positive impact on natural resources and ecosystems; the intentional placing of capital to solve environmental (or social) problems is the key factor that differentiates impact investment from responsible investment. Globally, about US$52 billion per year is committed to conservation projects from an estimated investment need of US$300 to $400 billion to preserve our natural ecosystems. Investment in sustainable food and fibre production has seen a strong growth in recent years and increased commitment from private sector.

There are no estimates available for New Zealand regarding conservation investment needs but it is widely accepted that significant investment is required to deal with the country’s freshwater, marine and conservation challenges, including the aspiration for New Zealand to become predator free. Direct government allocation for conservation for the 2018/19 financial year is about NZ$490 million; a further NZ$900 million is available in the environment budget, including NZ $100 million for the Green Investment Fund which is expected to stimulate $1 billion of private investment in high-value, low-carbon industries and clean technology. Additional funding for sustainable natural resource management is available from MPI and MBIE through initiatives like the Billion Tree Fund or the Provincial Growth Fund. Farmers, businesses and foundations also invest in environmental protection and ecosystem restoration. These investments are not sufficient in the face of the challenges we are faced with.

The investment opportunity for Aotearoa: leveraging productive landscapes to mitigate land use impact and regenerate ecosystems

There is interest from New Zealand and international investors to potentially invest in viable conservation projects in New Zealand. The challenge is to be able to leverage public investment and apply market approaches to attract new capital and invest in scalable solutions for sustainable land use management.

Catchments (where environmental pressure is often quantified) and productive landscapes (where ecosystems and value chain meet), and the interface between water quality and carbon goals, present us with “hooks” for investment. The Tourism sector and the potential of local food economies provide further levers for investment propositions.

In broad terms, the investment opportunities are generated by deploying capital to transition existing farmland to regenerative land use that achieves superior environmental performance and resilience, reduced exposure to rising input costs and higher prices for production.

Investment opportunities include:

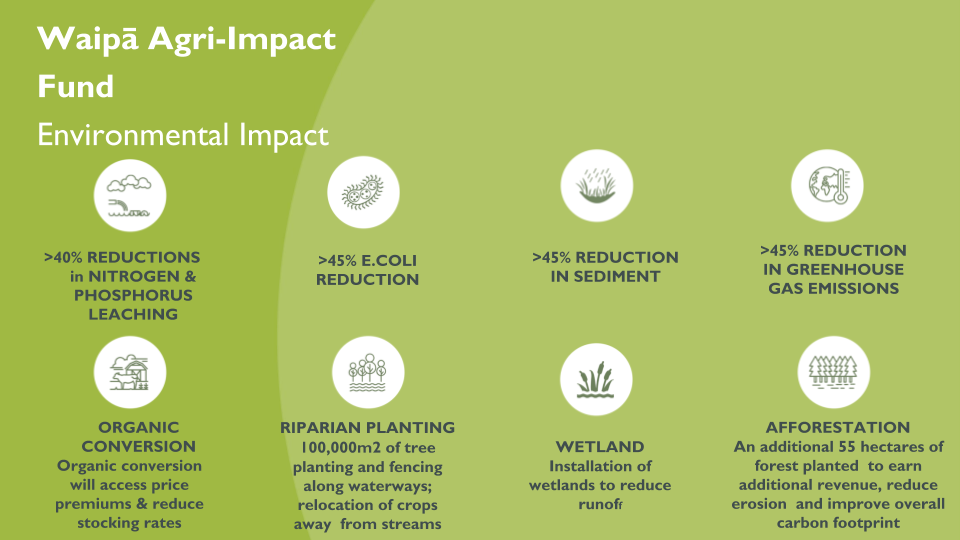

- Conversion of dairy and drystock farms to regenerative/ecological status. This is underpinned by organic certification (as a condition of accessing premiums and credibility) and applying a wide range of mitigation measures in farming and forestry based on their environment (nutrient, e.coli, sediment and carbon) and financial impact (premiums, opportunity and capital costs, carbon credits etc):

- Stocking rate reduction

- Selective afforestation of unsuitable pastoral land

- Riparian planting along main waterways

- Pasture change and removal of artificial fertiliser

- Paddock ‘buffer’ fencing: Separation of grazing blocks to increase biodiversity and provide shade.

- Sediment retention: Installation of sediment retention ponds for main streams discharging into the Waipa River.

Agri-tourism and eco-tourism

- Supply chain development (manufacturing, distribution, certification) for new products that may not immediately have a pathway to export market but can capitalise on tourism demand and local consumption.

This approach builds on New Zealand’s expertise in conservation and agri-business to develop new investment propositions that increase climate resilience and provide solutions to environmental impacts while enhancing the value of the asset (farmland, soils, ecosystems) and achieving appropriate returns.

The Waipa case study presented in this series is an example of how impact investment opportunities are identified and the impact and financial returns expected.

Some issues to consider in impact investment

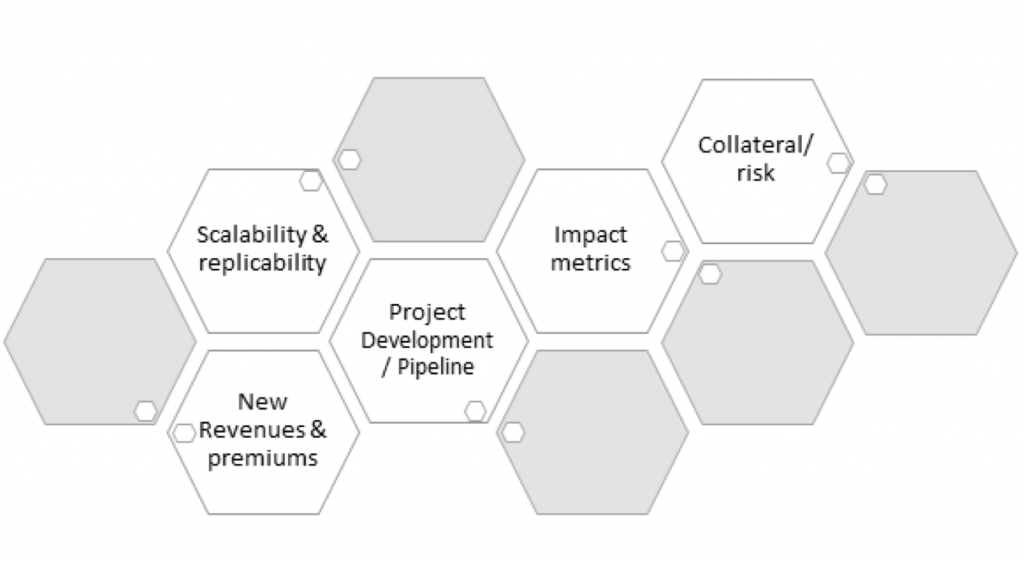

Conversations with prospective investors in New Zealand and insights gathered from international experience with conservation investment point to a number of issues that need to be addressed in order to get access to capital. These issues are not typically faced in conventional investment, where the capital market (demand and supply) is well developed, investment risks are understood and performance metrics are standardised.

However, the opportunity to invest in productive landscapes at catchment scale – with established agriculture and forestry revenues as well as tourism in some cases – offer solutions about how to unlock finance and seek environmental returns as well as financial ones. Recent knowledge and practices are being considered to account for credible measures that lead to carbon reduction such as riparian planting or wetland restoration. Additionally, there is more information on the valuation (and pricing) of other ecosystem services such as water purification and availability that will eventually provide new lenses through which to make investment in productive landscapes and attract investors motivated by environmental interests. The Emissions Trading Scheme has already established carbon as a fungible product that is well understood and accepted by investors in agri-forestry in New Zealand and abroad and it can help strengthen revenue and cash flow and increase the appeal of investing in conservation.

One of the key challenges in conservation investment (as highlighted by investors) is project scale and potential to replicate. Conservation interventions and mitigation on individual farms– such as riparian planting, wetland creation, marginal land afforestation – continue to be small in scale and not necessarily set up based on a strong understanding of return and impact maximisation and replication.

The focus in New Zealand on catchment-level environmental outcomes and regulatory limits – specifically as it pertains to water quality and availability – provide a viable pathway to pursue scale and attract investors. Conservation investments at individual farm levels that are scalable throughout a catchment also provide for project pipeline and deal flow with appropriate risk/return profiles and management track record that investors seem to favour. The on-going revenue of an operational farm and understanding of farm operational profits and cash flows brought about by potential new revenues (e.g carbon credits or high-value/lower impact produce like manuka honey) or premiums (e.g certified organic produce) as result of mitigation measures are a key step in developing viable impact investment propositions and reduce risks. Developing appropriate impact metrics to demonstrate investment effectives (financial and non-financial performance) and provide for accountability and transparency to investors as well as stakeholder groups (regional councils, iwi, environmental groups) is critical for the successful uptake of impact investment in NZ.

Addressing the issues above early on in the process of project development will help inform the business model and reduce financing costs.

Leave a comment