Company Reports: The surprising reason why firms must account for the six capitals: PART 1

We’ve just had that season again – no, I don’t mean for giving presents, but for presenting company reports. Eye-glazing for most of us, but vitally important for the integrity of business and the employment and other benefits it creates.

But a big shake-up is now well under way.

In 2010 Mervyn King announced to the Johannesburg Stock Exchange that listed companies had two years notice of the requirement to prepare integrated reports: gone were the days when a company could present a financial reports that excluded its social and ecological externalities.

New Zealand has discussed the virtues of triple bottom line, ESG (ecological, social and governance) and sustainability reporting since at least the early 2000s. Several early adopters have been preparing award-winning sustainability, corporate responsibility and integrated reports for several years, including Air New Zealand, Countdown, Fletcher Building, Foodstuffs NZ, Jasmax, KiwiRail, New Zealand Post, Sanford Limited, Urgent Couriers, Vector, Watercare and Z Energy. (This is not intended to be a comprehensive list, and additions are welcome in the comments box.)

These and other organisations have realised a suite of financial, reputational and competitive benefits from integrated, responsibility or sustainability reporting, and have been independently recognised for it.

But when I looked through the New Zealand stock exchange listings for other likely contenders for sustainability or integrated reports, there were also some absences. Why?

What compelling argument would persuade any firm – good, bad or poor performer – to do it?

The answer is not what you may first think.

In this two part article, I will argue that the real argument for every business to do integrated reporting against the six capitals is to become a learning organisation.

What’s so good about that? Check out the Harvard Business Review’s most cited paper in 60 years. It’s world-leading business commentator Michael Porter’s 1990 paper on competitive advantage.

“How an industry responds to environmental problems may be a leading indicator in its overall competitiveness … Only those companies that innovate successfully will win. A truly competitive industry is more likely to take up a new standard as a challenge and respond to it with innovation.” Michael Porter & Claas van der Linde 1995

Let’s look at the six capitals and see how and why businesses working with them develop their learning capability – the thing that delivers competitive advantage.

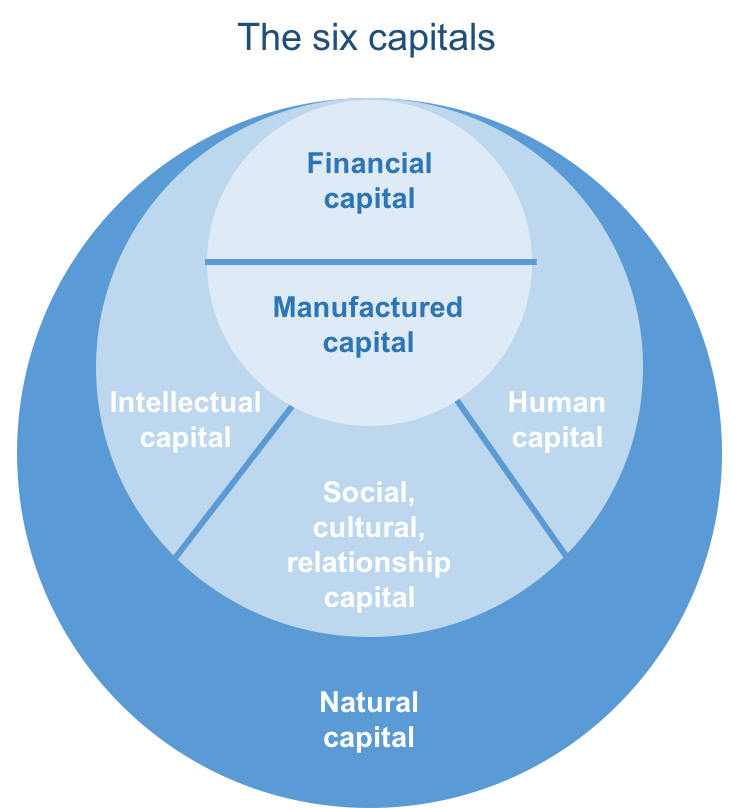

The six capitals

I’ve written an overview of the six capitals for Pure Advantage from the point of view of measuring the dollar return on investment in natural capital.

The diagram shown is from the International Integrated Reporting Council (IIRC), and I’ve interpolated “cultural capital” into social and relationship capital to recognize its value to New Zealand Inc.

“We know that for some entities up to 80% of their perceived value is not included in their annual reports,” says Ray Skinner of Sustainability Matters. “We also know there are numerous risks and opportunities which are not included. So why can’t, or don’t we, provide reports which tell all interested parties what they would really like to know, which is usually far more interesting than the arcane financial figures?”

I believe the six capitals approach and the IIRC’s principles of reporting offer enormous scope to companies wanting to consider how they create value, so I’ll focus more on the capitals themselves than the form the reporting takes (more on that here).

“Integrated Reporting makes visible the value in managing sustainability. Thus, it can highlight the business case for managing sustainability impacts”. Dr Carol Adams

Reversing the view of value

The focus on creating value across the six capitals and explaining that to stakeholders, is, as the IIRC says, the primary purpose of an integrated report.

We have taken a leap of faith in providing significant transparency in order to highlight the interdependence of our financial success with the sustainability of everything we are involved with, and trust this can serve as an example for continuous value creation. Volker Kuntzsh, CEO Sanford.

This apparently subtle change is a radical shift from an “extractive” to a “constructive” view of how to deliver value.

Too many companies have thought the way to benefit shareholders and customers was to extract the maximum value from all their assets – from their financial, manufactured, human, intellectual, social and natural resources – effectively across all six capitals.

The focus on creating rather than extracting value is utterly – and transformatively – different. Perhaps paradoxically to some, it delivers even more financial value than the extractive model. But I’m getting ahead of myself.

The Fortune 500 factor

Way back in 1990 as a bright-eyed young sewage scientist, I read an article in a magazine whose name is lost in the mists of time. The authors analysed the performance of the firms in the Fortune 500, America’s biggest listed companies in order to find out if there were any features that made the best-performers stand out from the rest.

What fascinated me was that the stragglers – those with the lowest share value and return to investors – were not only more likely to be polluters, they were also more likely to have extremely bad staff relations, very poor customer relations, problem with the tax department, problems with their lenders and insurers and more … all of which contributed to their poor financial performance.

I’ve followed this stuff ever since.

So let’s take a look at some compelling reasons why a company performing well or badly might want to examine how it manages its value across the six capitals. I’ve categorised them into drivers external to the organisation and drivers from within.

External business drivers for integrated reporting

Perhaps not surprisingly, the leading external driver for integrated reporting across the six capitals is compliance.

One unlisted New Zealand company I know obtained a third party environmental certification – a Global GreenTag eco-label – for their key products to facilitate their exports into key markets – but they had to prepare a sustainability or integrated report within one year of applying for certification.

More commonly, though, it’s stock exchange listing requirements that are requiring the preparation of integrated reports. For example the Sustainable Stock Exchanges 2016 progress report found that:

- 58 stock exchanges, representing over 70% of listed equity markets, had made a public commitment to advancing sustainability in their market and are now official SSE Partner Exchanges

- 12 exchanges incorporate reporting on environmental, social, and governance (ESG) information into their listing rules

- 15 provide formal guidance to issuers

- 23 have committed to introducing new ESG reporting guidance.

Now the New Zealand Stock Exchange is currently looking at the idea.

A key challenge for leadership is to make sustainability issues mainstream. Strategy, risk, performance and sustainability have become inseparable; hence the phrase ‘integrated reporting’. Mervyn King in the King III Report

Other external drivers that may influence business include:

- risk management: the World Economic Forum listed five environmental risks among the 28 identified in its 2015 annual report, and the Norwegian stock exchange says that investors “are increasingly attaching weight to a range of risks related to corporate sustainability. These risks include climate issues and the environment”.

- reputation: companies with painful experiences around compliance and reputational harm may also decide that pressure of public opinion is a sufficiently strong driver to adopt more robust and transparent reporting of their improved practices

- savvy investors and increasingly, investment fund managers, are looking for consistently good long term returns and those looking for socially and environmentally responsible investments, including giant national pension funds, want to see enough information in companies’ reports to inform their decisions and track performance

- lenders, insurers and credit rating agencies many only engage with firms once a year or when they’re in difficulty, but are increasingly risk averse, and this is reflected in their ratings and fees. Increased costs to firms deemed to have higher risk, including environmental, may drive firms to examine and disclose their material risks

- the smartest of the prospective employees, government regulators across the capitals and other interested parties such as NGOs and local communities are increasingly looking at company reports to assess their standing as a good employer and a good corporate citizen

- firms in fields such as horizontal or vertical construction (think roads, tunnels, pipes and cables vs buildings, dams or windfarms) face procurement requirements that place a big emphasis on non-price attributes relating to their social, environmental and sustainability performance. It’s not a big step to see some of these customers – and even some proactive suppliers – deciding to report across all six capitals as a risk mitigation overview for procurers

- supply chain management is a significant and growing driver of better ESG performance: large companies adopting integrated reporting may support their suppliers to start doing the same, in a drive for more transparency

- the environment itself may act as a driver where resources are scarce, compromised or contested in ways that that pose a risk to business viability – think coal extraction, tar sands, deforestation and the like

- legal compliance may in future become an explicit driver of integrated reporting against the six capitals, with several countries having passed or considering passing laws requiring companies to prepare integrated reports or in future perhaps requiring companies to measure, reduce and report greenhouse gas emissions in order to demonstrate progress towards meeting government climate change targets.

Internal business drivers for integrated reporting

Only by capturing the full picture of its value creation can a company thrive, and sustainability reporting is a vital tool in this process. Global Reporting Initiative

Some of the internal drivers in companies that decide they want to adopt integrated reporting, whether they are listed or not, include:

- urge to develop a sustainable business with a long-term vision, purpose and relevance

- ability to communicate a more holistic picture of a company to all its audiences. According to KiwiRail, this means that integrated reports can illustrate the interrelatedness and interdependencies among the factors affecting the organisation’s ability to create value over time, and this is vital to supporting a strategy that reflects what’s really going on

- desire to understand their social, economic and ecological aspects and impacts so as to consciously reduce risk and improve performance, including through better commercial, ethical, social and environmental performance and working more closely with their communities

- desire to look both ways through the aspect and impacts mirror – as Lisa Martin of Sanford says, to also assess the impacts your people, your business model and the environment have on the short, medium and longer term, and what you can do to mitigate or leverage them

- wish to deliver value beyond the ends of the supply chain – beyond suppliers and customers, to the people and places in and around the entire value network

- desire to strengthen engagement with staff including recruiting, developing and retaining the best people

- desire to attract the investors they want: research finds that firms producing integrated reports do indeed have a “more long-term oriented investor base with more dedicated and fewer transient investors”

- aspirations to live by their values of ethical responsibility and transparency

- going beyond risk management to seizing business and other opportunities around environmental, sustainability and other sources of uncertainty

- pursuit of innovation, agility and resilience

- drive to understand and consciously manage the whole business for positive outcomes,

All these factors in their different ways emphasise that the focus needs to be on how the company’s strategy and business model create value over the short, medium and long term.

Of course, the decision to pursue an integrated report “is not for the faint hearted,” says Lisa Martin, Sanford GM Sustainability. “It requires a major commitment for a total change in internal processes and business view to be meaningful. It requires an ‘integrated thinking’ approach to your business before you can realistically report in an integrated way.”

For faint and stout-hearted alike, I’ll unpack in Part 2 of this article the deeper reasons why companies should account for the six capitals and the potentially astounding effects this can have on company performance – regardless of the initial drivers for starting to do so.

[aesop_image img=”https://pureadvantage.org/wp-content/uploads/2017/05/Clare_Feeney_Part_1_Image_02_HBR-Decades-of-Influence-1670×861.jpg” align=”center” lightbox=”on” captionposition=”left” revealfx=”off”]Links to selected New Zealand integrated, corporate responsibility and sustainability reports

Ray Skinner and I have pulled together the list below of New Zealand companies which prepare sustainability reports of various types. Please note that this is not intended to be a comprehensive list, and additions are welcome in the comments box at the end.

- Aecom

- Air New Zealand

- ASB

- BECA

- BNZ

- Canon

- CentrePort

- Contact

- Countdown

- DB

- Downer

- Fisher and Paykel Healthcare

- Fletcher Building

- Foodstuffs NZ

- Fulton Hogan

- Genesis

- Jasmax

- Kathmandu

- KiwiRail

- KPMG (Citizenship report)

- Landcare Research

- Meridian

- New Zealand Post

- NZOG

- OceanaGold

- Opus

- Port of Tauranga

- Ricoh

- Sanford Limited

- Spark

- Toyota

- Trevelyan

- Urgent Couriers

- Vector

- Vodafone

- Watercare

- Westpac

- YHA

- Z Energy 2016 Annual Report and its stand on sustainability.

Find out more about the What and How of integrated reporting:

- International Integrated Reporting Council (IIRC)

- International Integrated Reporting Framework

- IIRC Six Capitals Background Paper

- Materiality in integrated reporting

- Global Reporting Initiative (GRI): the G4 Guidelines have recently been superseded by the GRI Standards, the first global standards for sustainability reporting against a comprehensive set of corporate responsibility indicators

- The Natural Capital Protocol – see the New Zealand organisation here

- World Business Council for Sustainable Development: Sustainability and enterprise risk management – The first step towards integration

- Where it all started – thank you, Prince Charles!

Acknowledgments

I am very grateful to friends, family and colleagues for their deeply insightful and helpful comments. Not all of them wanted to be named, so my heartfelt appreciation goes to (in alphabetical order by first name) Fonda Smyth, James Feeney, Jane James, Lisa Martin, Ray Skinner – and to the others who know who they are!

Leave a comment