At last, momentum is building towards a low emissions future. Now, 26 years after the signing of the UN Convention on Climate Change, we see commitments to reduce emissions from New Zealand corporate leaders, Councils and Government. But there is a missing piece in the jigsaw. Most of New Zealand’s investment still fuels the polluting economy. We need a massive switch in funding towards low emissions and sustainability.

Change has started. Conscious consumerism is on the rise internationally and this is extending to financial investment. Increasing numbers of the public are now waking up to the fact that their money is invested in companies that do not reflect their values. In New Zealand, 95 percent of Kiwisaver investors think that environmental, social and governance (ESG) factors should be considered as part of investment decisions.

But few investors currently follow through to align their investments with their values. For example, my analysis shows that less than two percent of Kiwisaver investments exclude production of fossil fuels, even though there is widespread acceptance that we need to transition rapidly towards zero emissions. Less than one percent exclude companies that make profits from gambling and pornography, even though that is a high priority for most investors. There are even fewer options to exclude investments in palm oil, GE, human rights abuses and animal cruelty.

The time is right for change. Many investors would like their funds to do good in society but are unaware of the options and put off by the complexity. They are often concerned about the lack of clear standards in ‘responsible investment’ and they need assurances that they will still earn a decent return.

These barriers can be overcome. I have developed a new NGO, Mindful Money, to massively scale up responsible investment and shift funding towards sustainability and low emissions. The opportunities are huge. Reorienting managed funds in New Zealand away from fossil fuels and exploitation into sustainability and low emissions have the potential to create a huge impact.

Ramping up the Transition to Sustainable Finance

Internationally, trillions of dollars are needed for the transition to a low emissions future and achievement of the Sustainable Development Goals. Most of the resources will need to come from redirecting investment from conventional finance towards investing responsibly.

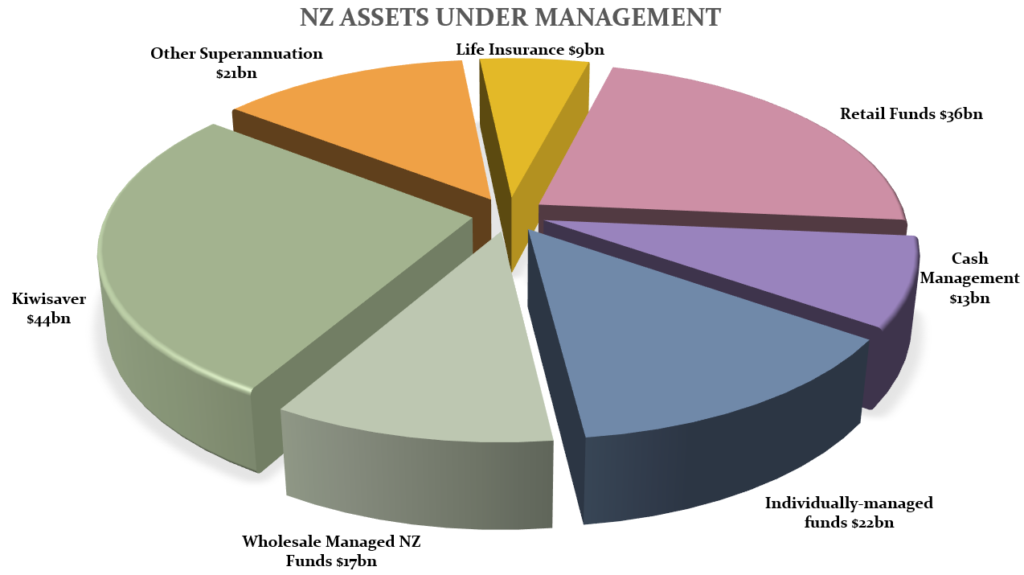

In New Zealand, the vast bulk of managed funds remain in traditionally-managed portfolios, and there are few sources of funding for a low emissions economy. The Government can play a catalytic role through initiatives such as the Green Investment Fund, to be capitalised at $100m. However, the vast bulk of investment needs to come from the private sector, and specifically from the $162bn invested in managed funds.

Kiwisaver investors will be increasingly important for the transition towards sustainability. It is a rapidly growing pool of investment. Kiwisaver funds are forecast to increase from $44bn at end 2017 to around $200bn by 2030. In addition, the majority of Kiwisaver funds are invested in New Zealand. Fiftyfour percent of Kiwisaver funds are invested in New Zealand, compared to only Fifteen percent of NZ Super Fund investments. Importantly, Kiwisaver investors comprise a broad cross-section of working Kiwis, and it is easy for them to switch towards more responsible funds.

From Ethical Investment to Responsible Investment

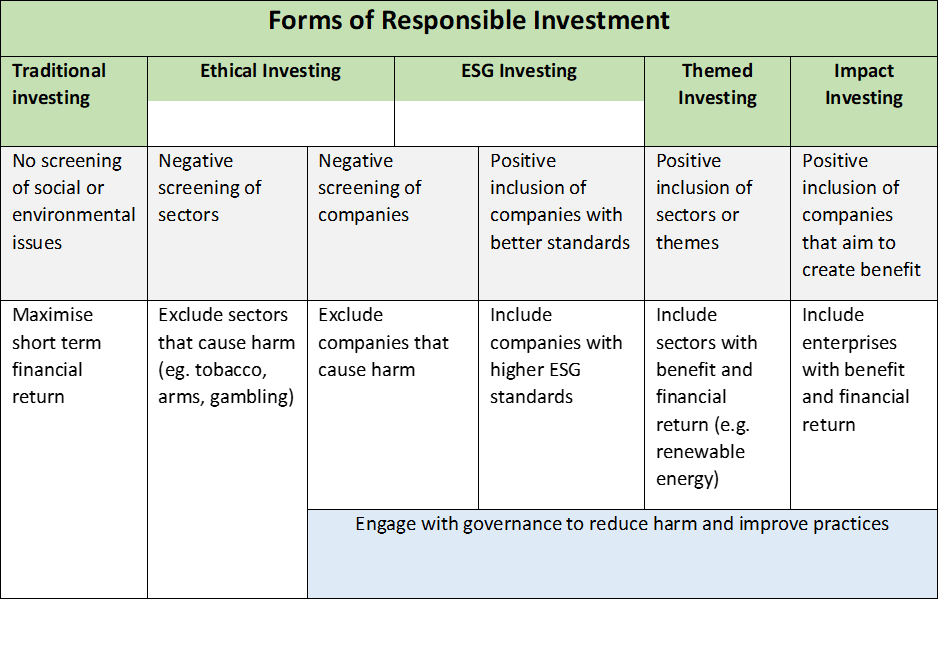

Ethical investment is not new. The Quakers refused to invest in companies engaged in the slave trade 300 years ago and subsequently excluded alcohol, gambling and weapons. In the 1980s, activist investors boycotted investments in apartheid South Africa. Until recently, ethical investment has remained a small niche market. Mainstream investment has continued to seek the highest short-term financial return, with little regard to the social and environmental consequences.

Investors choose different approaches to aligning their investments with their values. A common starting point is to exclude sectors with damaging impacts. This was evident when there was an outcry over Kiwisaver funds invested in tobacco and cluster bombs in 2016. It showed that Kiwisavers care about where their money is invested. Investment fund managers responded by excluding companies in the tobacco and ‘controversial weapons’ sectors, but it was a missed opportunity for a more significant step towards responsible investment.

In New Zealand, none of the largest investment funds has excluded fossil fuels from their portfolios, but some smaller funds have divested. The recent decision by Simplicity to divest from companies producing fossil fuels by the end of this year was an important step, joining other fund providers such as Booster, SuperLife, Christian Kiwisaver, Medical Assurance Society and Quay Street. There are now options available to Kiwisaver investors.

The second approach to responsible investment is investing in companies that have high Social, Environmental and Governance (ESG) standards. ESG investing has increased sharply in recent years after growing evidence has shown that good ESG management results in less risk and higher returns. This is not surprising – companies that do not pollute or exploit their workers have a better reputation, fewer fines, less waste and higher productivity. High profile scandals, such as the Enron fraud, BP Deepwater Horizon oil spill and Volkswagon cheating on emissions, have shown the huge financial costs that result from poor ESG practices.

The evidence of good returns from ESG has persuaded some of the largest asset managers internationally to sign up to the Principles for Responsible Investment, with membership comprising over US$70 trillion of assets under management. However, membership is no guarantee that responsible investment is fully implemented, and clearer standards for good ESG management are required to counter allegations of greenwashing.

Six New Zealand fund providers are now certified by the Responsible Investment Association of Australasia (RIAA) for ESG management – AMP Capital, Booster, Kiwi Wealth, Medical Assurance Society, Mercer and Pathfinder. RIAA’s certification ensures that investment funds use ESG analysis in constructing portfolios, provide transparency on their holdings and policies, and exercise their corporate governance responsibilities to raise ESG standards and hold the Directors of companies to account for poor practices.

Certification can be complemented by adding up the ESG scores of the companies that make up a portfolio, using research undertaken by the major rating agencies such as MSCI and Sustainalytics. These certifications and measures can provide assurances that investment portfolios are invested in companies with high ESG standards.

A third, more committed approach is investing in the companies that proactively create benefits in society, through investments in sustainability-oriented sectors, such as affordable housing or renewable energy (sustainability-themed investment), or in enterprises with a social and/or environmental purpose (impact investment). There has been rapid growth in these funds internationally, led by increases in the issue of Green Bonds, growing at over Fifty percent per year, and Climate Bonds.

In New Zealand, investment funds offer limited choices in creating a positive societal impact, but the first steps have been taken. Contact Energy has issued a certified green borrowing programme and Auckland Council has raised $200 million for investment in electric trains, certified as a Green Bond. In equity investments, themed investment includes the Pathfinder Global Water Fund and a wholesale fund, the Impact Enterprise Fund has recently been launched. These are promising steps forward.

There are still a few choices available to New Zealand retail investors who want to invest in diversified funds with a social purpose. They can invest in individual companies that aim to create a positive impact, but they face high risks from an undiversified portfolio. They can also access international impact funds, but need to deal with complex Foreign Investment Fund tax rules. More impact fund offerings are needed and the newly-formed Impact Investing Network has been established to promote impact investing in New Zealand.

The Winds of Change

Change is coming. There is growing recognition that finance is crucial for progress towards the Sustainable Development Goals and the Paris Agreement on climate change. New initiatives underway include the EU’s Action Plan for a cleaner and greener economy, and government-led initiatives in UK, France, Norway and China. The recommendation for a low-emissions investment strategy for New Zealand, contained in the Productivity Commission’s draft report, provides a starting point for a coordinated approach.

Responses to climate change are driving action on sustainable finance, including initiatives led by civil society. The international campaign to divest from fossil fuels has gained support from universities, churches, Councils, financial institutions and most recently, Ireland. Over US$6 trillion of investors’ funds now exclude coal, oil and gas production. This reflects not only the moral case for divestment but also research showing that Eighty percent of global fossil fuel reserves are likely to become stranded assets. Moving investment from the fossil fuel intensive economy to low emissions companies is crucial.

However, in New Zealand there has been a chicken-and-egg dilemma. Providers are reluctant to offer new funds because they point out that existing responsible investment funds remain small. And from the investor perspective, there are barriers to investing in RI(Responsible Investment) – the credibility of RI claims is low, there is concern that financial returns from RI will be lower, and investors are daunted by the complexity of investment choices.

These barriers can be overcome. Certification of funds and data from rating agencies now provides the evidence to support or disprove RI claims. There is growing international evidence that financial returns will be higher and risks lower for high ESG portfolios. And investors can be presented with clear options for investing responsibly.

The time is right for a public awareness campaign, backed up by accessible information, to grow demand for RI. Mindful Money, is developing a campaign to promote credible forms of RI to public audiences. Social marketing and publicity campaign techniques will be used to engage investors and empower them to make investment choices that match their values.

Mindful Money will work in parallel with fund providers to grow investment in thematic and impact funds, play an active role in corporate governance, and strengthen the credibility of responsible investment.

There is a potential sweet spot for investors, investment managers and the societal interest. The companies that do well in future will be those that follow advice from Larry Fink, CEO of BlackRock, the world’s largest investment fund:

“To prosper over time, every company must not only deliver financial performance but also show how it makes a positive contribution to society.”

Investors and investment managers will both do well, financially as well as ethically, when they apply this advice to their investments. The switch in Kiwisaver and investment funds towards sustainability can provide a powerful lever in the transition to a low emissions economy.

Leave a comment