Featured image credit – Ben Haggar //

The transport sector makes up about 20% of New Zealand’s greenhouse gas (GHG) emissions and rapid industry-wide reductions are crucial to achieve a sustainable net zero-emissions economy. It also represents one of the most difficult industries to decarbonize with steep technology cost hurdles and one of the most efficient incumbent fossil fuel supply chains ever developed.

The government is committed to funding renewable infrastructure in the COVID recovery, which will create new jobs and private sector investment. However, to ensure a timely and sustainable transition, amending policy mechanisms like the Road User Charge (RUC) exemption, to include green hydrogen and exempt trailers, is needed to stimulate the new heavy vehicle market, underpin deep decarbonization and drive long-term success.

Dan Kahn in a hydrogen fuel cell truck

The bulk of New Zealand’s vehicle fleet is made up of light duty passenger cars and utes, with heavy vehicles about 4% of the total vehicle fleet, yet they make up over 25% of the sector’s emissions. A single line-haul truck can do over 200,000 kilometers a year, over 1,000,000 kilometers in its first life before refurbishment – vehicles essential to our economy moving over 92% of all freight tonnage in the country even during the pandemic.

While these distances bring technical challenges to electrification, they also create opportunities.

For every line-haul truck a business converts to zero-emission, they will reduce the equivalent emissions of more than 150 cars.

It means the sector can focus deployment of zero-emissions infrastructure efficiently along main freight corridors and quickly develop a network. It means businesses can leverage the skills of an innovative industry to create new opportunities in green supply chains. Moreover, it means stakeholders can use existing policy levers like a RUC exemption to incentivize early adopters, drive market uptake and create lasting economic parity for widespread fleet transition.

What is the Road User Charge (RUC)?

The RUC is levied on all diesel vehicles based on weight and kilometers travelled. The annual revenue, about $1.8bn, goes to the National Land Transport Fund (NLTF) which is used to provide road maintenance and improvements. The RUC rate increases with weight, axle and trailer configurations which reflects the damage inflicted on the roading network. RUC licenses are paid for in advance by operators and there are several systems, paper and electronic, to ensure rates are paid accordingly. A typical line-haul truck and trailer combination can be paying more than $0.60/km in RUC rates depending on its number of axles.

RUC and CO2 emissions

There is also a direct correlation to RUC rates and CO2 emissions. Heavier trucks pay higher RUC rates and consume more fuel than lighter trucks and therefore emit more CO2 per kilometer travelled. Hypothetically, if you take the $0.60/km example above, and imagine it charged on a per-tonne of CO2 emitted basis, the RUC rate would equate to over $400/t-CO2 (factoring in that a truck that consumes about 55 litres diesel per 100 km, and each litre of diesel burned, emits 2.69 kilograms of CO2).

Providing an exemption from the RUC rate as a means to decarbonize is a compelling enabler. It offers a targeted carbon reduction incentive now when technology costs are elevated and adoption rates low — rather than waiting for the industry-wide ETS to increase (currently at around $30/t-CO2). Later, the incentive could scale back as costs approach parity with incumbent technology.

A RUC exemption already exists but for battery electric vehicles.

The RUC Act revisions of 2012 includes an exemption for light electric vehicles from 2012 to 2021, an additional exemption for heavy electric vehicles was added in 2017 until 2025. While we’ve seen some uptake of electric buses and small electric trucks as a result, there is an unrealized opportunity to dramatically increase market growth.

Unfortunately, when the definition of ‘electric vehicle’ was written into the RUC Act, fuel cell vehicles were not on the commercial horizon. The Act defines an electric vehicle as one ‘with motive power wholly or partly derived from an external source of electricity’, inadvertently excluding green hydrogen. Hiringa Energy has a view that while hydrogen produced from clean electricity and biomass would certainly meet the intent of the exemption program, the definition would need to be changed to ensure green hydrogen powered trucks would receive the benefit.

Revisions to include green hydrogen will unlock greater zero-emission opportunities for commercial operators, particularly because hydrogen’s payload, range and fast refuelling advantages are best suited to electrify the heavy fleet.

It is also important that a revised definition only recognizes green hydrogen, i.e. hydrogen produced from clean electricity or biomass. Brown hydrogen – produced from the reformation of natural gas – must be prohibited from receiving the exemption as the Well to Wheel (WtW) emissions of a brown hydrogen powered vehicle can be worse than incumbent diesel. Any incentives enabling brown hydrogen will only delay the establishment of a low-cost green hydrogen supply chain.

The exemption should also include trailers paired to RUC exempt vehicles. This encourages operators to scale their zero-emission assets, and puts more incentive forward for decarbonising the largest emitting vehicles in the fleet. Additionally, the exemption period should be extended to 2028, giving green hydrogen technologies the same runway as the original electric heavy vehicle exemption, and heavy truck owners ample time to transition their fleets.

| What is a fuel cell vehicle and green hydrogen?Fuel cell vehicles (FCVs), powered by green hydrogen, are lighter than their zero-emission battery electric cousins (BEVs), meaning they can carry heavier payloads further. They are refuelled in minutes rather than hours — key for heavy vehicle operators where on-road time is money.

FCVs are at their core, electric. The key component, a fuel cell, electrochemically combines hydrogen and air to create electricity, which drives an electric motor, and water vapour, which is vented. Compressed hydrogen is stored onboard the vehicle in high pressure tanks, and while less efficient than directly charging a battery, green hydrogen can be produced from renewable electricity or biomass, and stored for long periods of time without degradation. This means green hydrogen production supplements increased intermittent renewable energy sources such as wind and solar, monetizes excess power produced during off-peak times, and encourages greater electrification without emissions. |

The case to support a RUC exemption

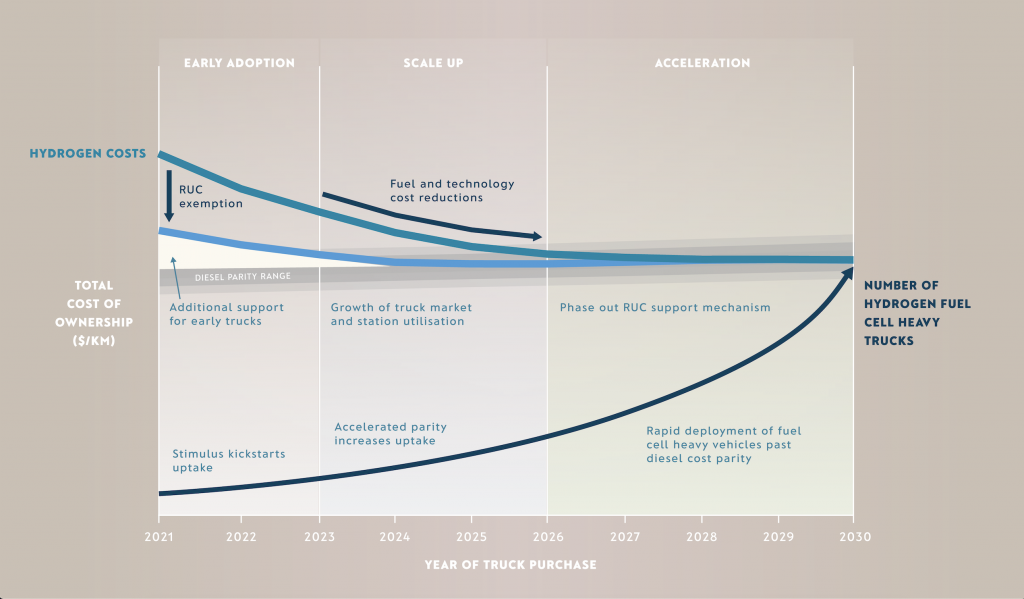

All vehicles damage roads but the number of new trucks that could benefit from stimulus is small (around 1% of the total fleet), and the potential impact emissions is huge. Heavy electric technologies are in the early stages of the cost curve. This means scaling up from 10s to 100s to 1000s of vehicles has steep cost reductions per annum, and market growth at the beginning of this decade can drive capex decreases of up to 13% per year. An exemption program which expires by a specific date, 2028 for example, means that as vehicles get cheaper, and scale drives fuel costs down over time, less RUC support is given throughout a vehicle’s life.

The support for RUC exemption shifts early-adopter economics, achieving total cost of ownership parity with diesel between 2023-2025, and unaided parity between 2026-2028. Assuming the exemption program ends when parity is achieved, the reinvestment of RUC revenues to stimulate the industry would total to 2 – 3% of what would otherwise be directed to the NLTF over that time period (or $280M of $13.8B by 2028 assuming 2019 NLTF contributions).

Once unsupported parity is met, the zero emission heavy truck market will grow rapidly.

Looking out to 2035, when stimulus led market growth has driven uptake of 10,000-20,000 zero-emissions heavy vehicles, as much as 10% of all transport emissions could be reduced, or 1,500,000 tonnes of CO2 per year. At that time, when the zero-emissions truck market will have scaled, a fractional levy on vehicle classes that received the exemption could rapidly repay the foregone revenue.

It’s crucial we act now. NZ brings in about 6,500 new heavy vehicles per year, capping the market’s ability to transition the fleet to zero-emission. Every new imported truck locks in an average of 17 years of diesel emissions and new vehicles do the most kilometers, and emit the most CO2.

Pathway to Cost Parity

The steps for government and sector stakeholders are threefold:

First, the government must create clear reduction targets for transport emissions across the commercial sectors (soon to be addressed by the Zero Carbon Act).

Second, the government should stimulate investment in zero-emission heavy vehicle refuelling and charging infrastructure across New Zealand — happening already via the “shovel-ready” project investments and Low Emission Vehicle Contestable Fund (LEVCF).

Third, the government should leverage the existing RUC exemption legislation and amend it to include green hydrogen powered vehicles (which are inadvertently excluded), and exempt trailers pulled by zero-emission vehicles extending the exemption period to 2028.

New Zealand’s truck market is bespoke and small relative to most other countries, however, Hiringa Energy and partners have leveraged domestic momentum to secure early supply of suitable vehicles for the national refuelling network. Long-term support like the RUC exemption is key to continued market growth and emissions impact, because as the zero-emissions heavy truck industry becomes more competitive, NZ’s relevance to international manufacturers will diminish.

Soon, the minimum number of vehicles for an original equipment manufacturer market entry will expand beyond normal fleet turnover, making early adoption more costly, hindering fleet uptake and putting emissions reduction targets beyond reach.

New Zealand isn’t the only country to offer a road tax exemption.

Switzerland has a vehicle market roughly twice the size of New Zealand, and has successfully leveraged a similar exemption to deploy over 1,600 hydrogen heavy trucks by 2025. With the exemption, the trucks are competitive with diesel equivalents and are stimulating investment in green hydrogen refuelling infrastructure, powered by Switzerland’s hydropower resources. Once at scale, the trucks will achieve unsubsidized parity with diesel.

Heavy transport plays a significant role in keeping the NZ economy and essential services moving and must decarbonize to meet international climate obligations. Modelling an effective RUC exemption, the transportation sector can design a similar program to Switzerland, leverage NZ’s renewable energy ecosystem and lead the southern hemisphere in decarbonizing heavy freight.

The transition to zero-emissions must be enabled to kick start an industry-shift away from diesel and unlock national green supply chains.

Let’s get rolling!

Leave a comment