In Part 1 of this article, I looked at how the environment and sustainability is a brilliant proxy indicator for overall quality of a company’s management. I reiterated how accounting across the six capitals reverses the source of value from extractive to creative and concluded with some of the drivers for companies to start accounting across the capitals.

Now let’s unpack the potentially astounding effects on company performance of accounting for the six capitals – regardless of the initial drivers for starting to do so.

The acknowledged pinnacle of business development is the learning organisation. How do we define that – and how does better environment and sustainability management get us there? Let’s see.

REAL value #1 of integrated reporting: the learning organisation

Continuously gaining and practising new knowledge – building a learning organisation – is the only permanent source of competitive advantage. It’s a necessity of the modern enterprise.

– Michael Porter and Peter Senge

Michael Porter and Peter Senge, leading experts in competitive strategy and business management, both agree that sustainability is the most far-reaching and effective change agent available to businesses. They also say that companies which have built their learning capacity are the ones that will create a sustainable future – and thrive in it.

And yes, such firms may even change the world. I believe the Integrated Reporting system is now one of the most powerful tools for beneficial social and environmental change in a world crying out for it.

But when is the right time for a company to start doing Integrated Reporting? Every firm, listed or not, already reports on its financial capital. Tackling even one of the others is a great start. Here I focus on environmental value creation as a place to start the learning journey.

REAL value #2 of integrated reporting: the higher altitude factor

I can’t understand how these firms manage to stay in business when they know so little about their operations.

– Exasperated Landfill Waste Minimisation Manager.

Here’s the thing – a company that really wants to improve its performance across the six capitals and address the full suite of risks it faces, has to involve everyone in the process – shop floor to top floor within the organisation, and all its external financial, value chain and community stakeholders.

“A holistic approach to reporting requires the business to report on the connectivity of all its resources, relationships and financials,” Lisa Martin, Sanford’s GM Sustainability, points out. “That’s where an integrated report differs materially from a more ‘siloed’ triple bottom line report. The integrated reporting evolutionary breakthrough comes when the business reports on these interdependencies and their future likely effect on value creation.”

Because sustainability is holistic and connected to everything else, firms that focus on it, even if they know their business pretty well, consistently discover genuinely new insights into their organisation. People in such firms say it’s because sustainability prompts them to see from a “higher altitude”, that “you’re required to see the whole system in which you function, not just your boundaried part”, or that it’s like “joining the dots” from a great vantage point that reveals how operations, observations, data, trends and ideas relate to each other. This is what grows your corporate knowledge and insight.

REAL value #3 of integrated reporting: the active causation factor

“The unexamined life is not worth living,” says Aristotle. Can we also say that the unexamined firm is not worth running? In today’s world, the answer has to be yes.

As we saw in Part 1, auditors who uncover poor company performance in any one area – employment matters, financial management, client relations, safety, environment or sustainability – usually see it across them all, and this inevitably reduces profitability.

We can look at how a company can create the changes it wants across one or more of the six capitals in terms of correlation and causality.

The argument by correlation is that a company with rigorous and thoughtful practices about sustainability ‘is likely to be rigorous and thoughtful about … everything else,’ says former Global Business Network chairman Peter Schwartz. He says it’s very difficult to assess the quality of a company’s management from the outside, but that “sustainability performance turns out to be a very good proxy for it.”

I’ve found we can make this correlation a causal one, as did one New Zealand civil construction company – it tripled its turnover within four years, solely as a result of rolling out environmental training throughout the firm, from directors, managers and staff to subcontractors. No other change was made over that period. Yes, its improved environmental performance yielded on-site efficiencies and savings – but the CEO believed this would only have accounted for about 25% of the increase in turnover.

Here’s how I account for the “missing 75%”. As the company became more “rigorous and thoughtful” about its environmental beliefs and practices, this created a culture where everyone in the company became committed to doing better, enjoyed learning new ways of doing things, saw the benefits, and became progressively more engaged and productive with respect to their environmental performance. From being close to going out of business because of its poor environmental performance, the firm went on to win a series of environmental awards.

But the genie doesn’t stay in the environmental bottle – the learnings are transferred to all the other areas of people’s work, across all the other parts of the organisation. It’s this lift in internal and external learning and engagement and in the firm’s deeper understanding of its own business that flowed on to generate the other 75% of the turnover increase that the CEO couldn’t account for.

The active causation factor leverages a shift from transactional to transformational change as a firm takes charge of what’s really going on.

Here’s where the various models of organisational maturity can help firms work out where they are and where they want to be.

Organisational maturity models

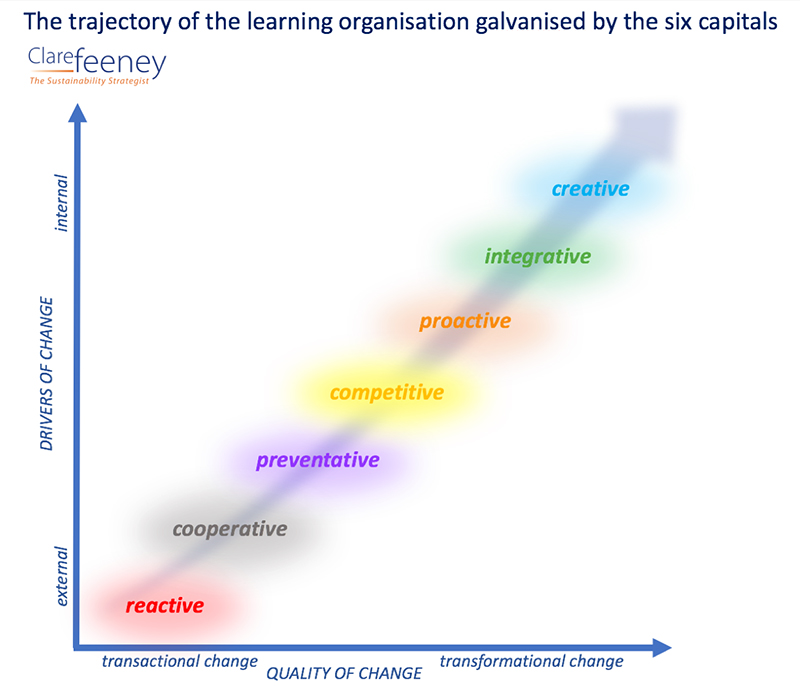

A 1990s article in the long defunct Tomorrow magazine defined four company attitudes to environmental compliance, ranging from defensive through cooperative and proactive to sustainable. I’ve seen it since in many forms, and in the diagram below, I’ve developed seven shades of learning along the way to true business sustainability.

- the shift from reacting to external drivers towards making conscious decisions about the organisation’s own vision for creating value for itself and others across the six capitals

- the shift in the nature of change from one-off transactional changes as issues and external requirements arise to a journey of transformation that delivers its own joy and excitement as well to the value creation process.

A company trapped in reactivity to external environment and sustainability drivers is “focused on business survival and bare environmental compliance,” says Fonda Smyth of the International Business Program with Nova Scotia Community College. As the necessary changes in practice become more internalised and culturally embedded, the company’s attitude changes to one of cooperation with environment and sustainability agencies, albeit as a market follower rather than a leader, she notes. Building on skills and knowledge gained in that process, it becomes more preventative. As it starts to look more widely beyond itself, it becomes more competitive in its market sector until it proactively embeds the approach into the organisation. With increased organisational maturity, the value creation approach is fully integrated into “how we do business”.

At last, with a more holistic view of how it can create value across all six capitals, the company fledges into a creative learning organisation; reflexively aware, future-focused, responsible, innovative, nimble, sustainable, adding real value across all six capitals and leading the way for others.

Too big and scary? Don’t worry – you can start anywhere so long as you know where it is! Organisations can come into the trajectory at any point, says KiwiRail’s Jane James. The journey is likely to go backwards and forwards in an iterative process rather than along a smooth or direct path. She sees the organisational maturity framework as providing a helpful analytical and planning tool to guide their ongoing strategy and performance improvement activities.

The organisational maturity factor means identifying where you are along the trajectory of a learning organisation and starting on the journey to true business sustainability from there. Test where you are with the help of the detailed criteria here.

What does this mean for our listed companies?

Our annual reports – dull and boring? Or a tool to empower our success?

– Ray Skinner, Sustainability Matters

As I was finishing this article, four items in the Business Herald caught my eye. Three were saying that the solid but unspectacular performance of New Zealand listed companies in the recent reporting season meant that companies were close to peak profit margins in a fully priced share market and that most of our companies have a limited growth outlook.

Just over the page was a fourth article about employment trends, with HR specialist Alan Pettersen saying that the smartest organisations “clearly see the global environmental wave that is gaining momentum” with the welfare of their employees “inextricably linked to the health of the planet”, and many employees expecting “their employers to take innovative action to make a contribution to a healthier and more sustainable future.”

How much more “good” growth could we measure if our listed – and other – companies – report not just on financial capital, but on the six capitals? And how enabling would a six capitals approach be for business in communicating their holistic story for creating enduring value?

Integrated Reporting allows you to tell a value creation story that is much greater than pure financial performance.

– Unnamed contributor

What does this mean for your company, listed or unlisted?

Ask yourself the following questions for reflection and analysis:

- Where would you plot your organisation in the diagram of the trajectory of the learning organisation?

- How ready are you to aim for thoughtful, creative development as a business by reporting across the capitals?

- What will be your unique contribution to a more sustainable world?

With all my best wishes for your journey!

Links to selected New Zealand integrated, corporate responsibility and sustainability reports

Refer to the list at the end of Part 1 of this article.

Find out more about the What and How of integrated reporting

- International Integrated Reporting Council (IIRC)

- International Integrated Reporting Framework

- IIRC Six Capitals Background Paper

- Materiality in integrated reporting

- Global Reporting Initiative (GRI): the G4 Guidelines have recently been superseded by the GRI Standards, the first global standards for sustainability reporting against a comprehensive set of corporate responsibility indicators

- The Natural Capital Protocol – see the New Zealand organisation here

- World Business Council for Sustainable Development: Sustainability and enterprise risk management – The first step towards integration

- Where it all started – thank you, Prince Charles!

Acknowledgments

I am very grateful to friends, family and colleagues for their deeply insightful and helpful comments. Not all of them wanted to be named, so my heartfelt appreciation goes to (in alphabetical order by first name) Fonda Smyth, James Feeney, Jane James, Lisa Martin, Ray Skinner – and to the others who know who they are!

Leave a comment